Last month, I was scrolling Twitter and saw this newsflash:

If someone raises $200M off an idea, it’s probably Adam Neumann. If it’s not, it’s worth looking into.

Limit Break has a star studded cast of game creators that dominated “free to play” games. Free to play games, such as Candy Crush, allow users to play for free initially, but encourage purchases for certain perks and access to more gameplay. Gabriel Leydon, CEO of Limit Break, previously created games such as Game of War, surpassing $3B in revenue (yes, free to play, $3BILLION).

Limit Break is focused on a new concept that they believe will replace free to play. They are calling it “free to own” gaming.

If you’re not a gamer, bare with me. I’m also not a gamer, so once we level-set on the free to own concept, I will explain the large significance of the concept to non-gaming environments.

What is “free to own”?

Free to own is the concept of giving away NFTs, gratis. Similar to how free to play games cost nothing to download on the app store and cost nothing to start playing, free to own NFTs allow you to start playing a game, for free, through the ownership of an NFT.

In other words, your access to the game is gated until you own an NFT, but you can claim it for free. On the surface, free to own is the same as free to play, with the exception of the introduction of NFTs as the access key to the game.

The catch: although the NFTs are free, there may only be a predetermined amount of “specific” (will explain) access NFTs available to claim. In turn, if you don’t get one of these from the initial NFT drop, you will have to purchase them on the secondary market from someone who claimed their NFT for free.

It’s easy to see how game designers will use this mechanic cleverly.

Example: Claim the “genesis shield” NFT, there are only 1,000 of them. After these 1,000 are claimed, no one else will be able to claim a “genesis shield” which brings the owner unlimited lives. Sure, the game designers will likely give out 10,000,000 more free access NFTs, but only the first 1,000 will be the specific genesis shield NFTs. As the popularity of this game grows, people who claimed one of the genesis shields can sell it on the open market at any point or enjoy it themselves.

While this distinction may seem byzantine, it is already playing out successfully in Limit Break’s ecosystem. NFTs that were given out for free are now selling for 4 ETH, or ~$4,200 at time of writing (which will probably will be $3,000 by the time you read this #HFSP #probablynothing).

Why will free to own takeover free to play?

History tells us that roughly 10% of free to play gamers will make a purchase in the game. This 10% of the user base drives 100% of the revenue for the game. The free to own business model is similar to that of free to play games, relying on “in game” purchases. However, the free to own business model has three main advantages compared to free to play:

Royalties: as NFTs change hands, game makers receive a royalty check for each sale (e.g., with a 10% royalty, Limit Break would get $420 if an NFT changes hands for $4,200).

Uncapped spend: Apple’s App Store restricts in-app purchases to $100. An NFT can be purchased for thousands or millions of dollars, greatly increasing the revenue potential. However, Apple recently stated that they still want their 30% cut of all in-app NFT purchases. It’s good to be king.

Ownership: Even if a gamer doesn’t understand or care about NFTs, people would rather buy something they can sell (even if they never intend to). If someone told you that when you bought a house, you wouldn’t receive a title deed, you probably wouldn’t buy it. I think people will think similarly about purchasing anything digital at some point soon.

In summation, gifting NFTs allows gamers to play for free by claiming NFTs to access the game. People will start to prefer property (NFTs) to rental (the current paradigm) as they begin to understand what ownership can be in the digital world. As some free to own games inevitably grow in popularity, those with the “genesis” access passes will benefit greatly through the game play or financially by selling the NFT (assuming the game designer built the structure correctly).

Free to own is equally interesting outside of gaming, and marketers should take notice before getting outmaneuvered by forward looking brands.

Free to own: a marketer’s wet dream

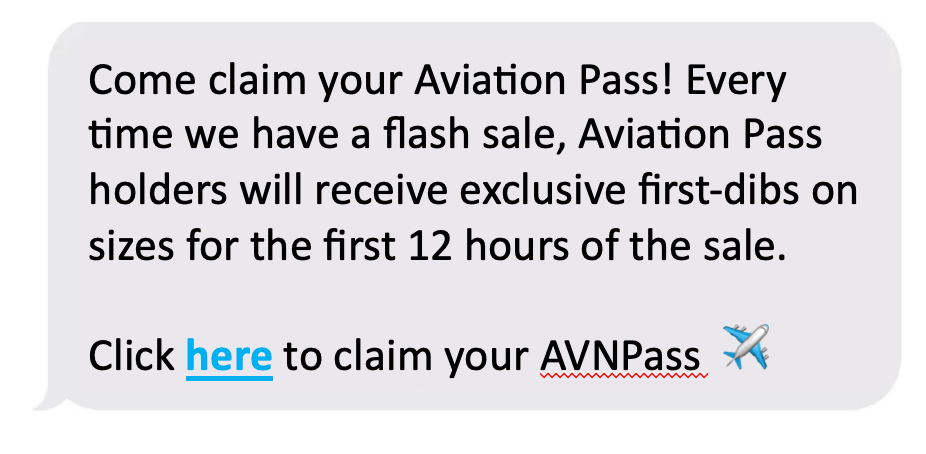

Free to own will become a lethal tool in the CMO’s panoply of attention grabbing tools. The classic SMS push notification used to look like:

will become:

Free to own will make customers feel recognized, driving additional sales through a new funnel for outreach.

As marketers begin to wield free to own, they will discover the following advantages:

1. Incentivize brand knowledge amongst customers

Back in 2015, I interned for a company called Expert Voice (formerly called Experticity). Their business was centered around the concept that the best salespeople for retail products are everyday people with affinities for particular brands.

Expert Voice knew that friends trust friends when deciding what to buy. For example, if my friend says he loves a specific ski coat, and I’m in the market for a coat, I’m likely to follow his lead. Expert Voice monetized this concept, incentivizing brand knowledge by asking people to prove their affinity to specific brands by having users take quizzes about their favorite brands in exchange for deep discounts for that brand.

Free to own brand NFTs serve the same function. If you own an asset tied to a particular brand, you’re likely to learn more about the brand that gave you this asset you can now use, sell, and tell your friends about. For example, someone receives a Starbucks NFT (for free) which is the basis for Starbuck’s new web3 loyalty program, and there’s a picture of 1912 Pike Place on their NFT:

Now, every time they order a “Pike Place Roast”, they know what it references. Without a doubt, I’m a nerd who likes to know random factoids, but those little “aha” moments increase brand affinity and will drive consumers to stick to brands that put in the effort to share their stories.

2. Skin in the game

Referral codes were the closest thing to “skin in the game” that brands could give people before NFTs. It was promos like “refer 5 friends, get $50 off your next purchase,” and so forth. While it’s definitely a powerful strategy, the upside for consumers is limited to each promotion.

Ergo, consumers lose their will to promote when the promotion ends.

The next generation of great marketers will understand that it’s more powerful to give free digital assets to people, as long as their system makes these assets worth something. There are a number of ways to make these digital assets worth something, such as embedding redeemable perks, leveraging the verifiable scarcity of the digital extension of the brand, and leveraging gamification elements.

Consumers are tired of prosy marketing campaigns driven by micro-influencers on Instagram, and will turn to brands that give them the opportunity to put skin in the game.

Referral programs will turn to free to own strategies to encourage natural evangelization (e.g., people will start to drink Starbucks because they own assets that prove Starbucks pays attention to them).

3. New customer targeting via crypto-wallet

Loyal customers can now be incentivized to purchase in real-time through their crypto wallet.

Direct targeting is nothing new, but the avenue marketers use to contact customers has evolved: snail mail —> E-Mail —> SMS—> crypto-wallet

Crypto-wallets take the customer from an email or SMS list → specialized group.

Now, targeted customers are not just a name on a long mailing list; they are now part of a group of people that has access to something special, curated just for them.

Crypto wallets are already becoming “less technical” and will end up looking like your Apple Pay Wallet, allowing users to scroll through their assets (NFTs) to use at will. The fact that the underlying assets are “NFTs” will start as inconsequential to most users… it’s just the technology that makes it work.

What should you do about it?

Don’t send snail mail, it’s not romantic anymore. If you’re a marketer and want to impress your boss, or you are the boss and your marketing team sucks eggs…

Better call En Passant Digital (yeah, it rhymes)

Website: enpassantdigital.com

Email: bryce@enpassantdigital.com

About the author: Bryce Baker is the co-founder of En Passant Digital, which designs and leads Web3 strategy for businesses. Bryce previously worked at Parthenon-EY as a consultant for private equity firms, focusing on buying and selling technology companies.

En Passant’s other partner, John Tabatabai, has led investments for Crypto VCs and consulted for projects across the NFT space. He orchestrated one of the largest grossing NFT projects, kickstarting the first NFT bull run in early ’21, creating over $200M of value. John is designing one of the most influential Metaverse Community projects ($300M valuation at time of writing) which launches shortly.