“Crypto is so complicated, can you help me understand it?”

“Of course I can. But I bought BTC in 2016, so my advice won’t be cheap.”

“Wow, I’m so lucky to know you. From now on, I will address you as Nostradamus”

“I’m doing NFTs!”

While every painter has access to the same color palette, infinite permutations lie at the hand of every artist. The power of the paintbrush is determined by the hand it resides in, not by the materials available. The thought of a brush lying idle next to red, yellow, and blue paint is intoxicating: all the potential in the world ready to be unleashed by a talented hand.

Instead of creating masterpieces, celebrities and brands alike are picking up the brush and taking selfies next to the canvas. “I’m doing NFTs!” they proclaim. The first step in NFTs is extremely unclear for most, even when it’s as simple as dipping the brush in water before painting.

My point in this rambling analogy is that many tools exist to bring valuable intellectual property on-chain, but it isn’t happening as often as it should. The knowledge base for NFTs is concentrated within the builders of the technology. At the dawn of every industry, the builders are the only ones who understand the potential in their creation.

In due time, those who see that potential but didn’t create it themselves will insert themselves in the new industry in any manner they can to profit (e.g., as investors, imitators, or service providers). The influx of new talent can spur industries to push the boundaries of creation far past what the initial builders imagined. Ethereum co-founder, Vitalik Buterin, could never have predicted the explosion of NFTs.

Complexity begets opportunity

The more convoluted the industry, the greater number of people will claim to understand it. This is because knowing ANYTHING in a complex industry will put you out of reach from the know-nots. Those who know very little about complex industries are able to mask their lack of depth with jargon-ridden sentences, and we trust these complex ramblings, a tool marketers have used for years.

Non-GMO, ammonia-free, anti-flamingo, auto-peptide-inducing, popcorn? Sold, you had me at Non.

Alas, Occam's Razor is defenestrated in front of our eyes, as the simplest explanations fall by the wayside.

The other influential factor in attracting services is the market size of the industry. As one of my favorite philosophers, Mr. Christopher Wallace AKA Biggie Smalls explained, mo’ money mo’ problems.

The factors of complexity and market size are why you don’t see “Lemonade Stand Consultants, LLC”. There’s only so many ways to shill lemonade, and only so much thirst that needs quenching on your block.

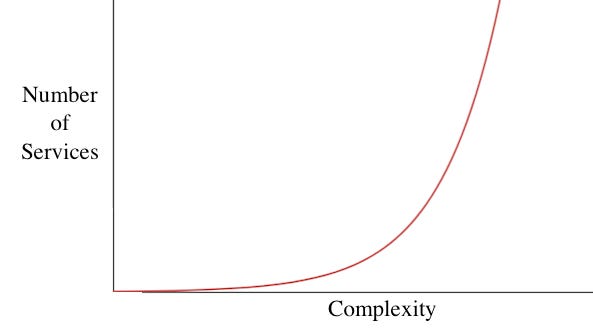

As the complexity of a given industry rises, the rate of the number of services entering the market also increases. Said differently, for each “unit of complexity”, more services enter than did for the last unit of complexity. The exponential graph looks something like this:

The reasons for the above are:

In highly complex industries, there is a greater need for hand holding.

If the barrier to understanding is extremely high, any knowledge that’s incrementally greater than 0 will seem substantial, so services can join more easily (I made a drawing to illustrate this concept below).

Picture a hypothetical scenario where a person / company needs crypto-services. This is person Z in the diagram below.

While person B is significantly more knowledgeable than person A, the difference is imperceptible to person Z. Person Z will therefore hire based on factors other than knowledge (more on these factors in the following sections).

The more complex the industry, the higher this wall becomes, as it’s impossible to know how much others can help you when the industry seems like a foreign language.

This leads to people who bought BTC in 2016 to say “I’ve been in crypto since 2016, how can I help you?” Everyone standing on the side of the wall with person Z is in the dark as to how much that person knows.

To add to the obfuscation, there are countless studies which have shown our tendency to blindly trust the opinions of the rich. We believe if someone has made money, they must be smart, and therefore they can help us do the same. While this is far from a golden rule, the fact that crypto has minted many multi-millionaires from small capital bases adds to the tendency to trust person A on the other side of the wall. If person A is richer than person B, he may win the services deal on that alone if he exudes wealth. Our story is far from over, as this isn’t where the nuance ends…

The best does not always win, even when it’s clear who is best

At the dawn of new industries, generalists dominate the services business. Knowing a little about a lot can take you far. Generalists can appeal to a wide base of problems, and there’s less competition in the industry as a whole when it’s still nascent, so solutions don’t have to be earth-shattering to be effective.

Let’s take strategy consulting, for example, where the Big 3 firms (Bain, McKinsey, and BCG) have dominated for the entirety of the lifecycle of the industry. As the creators of the “strategy consulting” industry, they have built the largest bank of “strategy consulting” knowledge, reputation, and logos.

However, this doesn’t mean everyone who needs a strategy consultant will hire them. Two main reasons:

Price: other firms can charge less and compete on price.

Specialization: other firms can specialize and become more knowledgeable on specific topics that make them uniquely qualified to solve specific problems.

As industries progress the competition for dollars increase, services specialize to solve the niche problems that arise.

If you want to have big biceps and don’t care about other muscle groups, just do curls. This is what specialized consulting firms do. When the job calls for big biceps, look no further than the guy repping curls in the mirror. If the job calls for an overall strong human, other firms will have to compete on price.

However, we all know the world isn’t as simple as “the best wins.” Politics preclude this from happening a lot of the time, and the best sometimes loses.

Stay with me, this will make sense shortly. Let’s take an example:

Coca Cola wants to increase sales in Utah, which has proved difficult because Mormons don’t drink caffeine. They want to hire a strategy consulting firm to help them untangle the problem. They create an RFP (request for proposal) that describes the problem and send it out to different consulting firms.

Coca Cola receives two bids for the job.

They can hire McKinsey, who has already worked with other large beverage companies such as Budweiser and claims they can use that knowledge to solve this issue. Or, they can hire Mormon Soda Consultants, who exclusively helps beverage companies navigate populations that skew heavily Mormon, but they have less “blue chip” logos in their client book.

For simplicity sake, let’s say they both charge the same amount.

The experience of “Mormon Soda Consultants” is much more closely related, so we would be led to believe that specialization would ensure they win this deal. They are probably better at solving this specific problem than McKinsey.

Let’s go inside the mind of the “decision maker” at Coca Cola, the person deciding which firm to hire.

Let’s say this decision maker, called Cindy, is Coca Cola’s head of the Western United States. She will be thinking about two things: the likelihood of success with each consulting firm and the possible outcomes for her personally. I have constructed two matrices below to visualize her thought processes.

The likelihood matrix displays how likely Cindy believes each scenario is to occur (assuming the specialized knowledge of Mormon Soda Consultants is legitimate):

The clear best chance at success by likelihood is to hire “Mormon Soda Consultants.” However when we look at the outcome matrix for Cindy, we come to a new conclusion.

The outcome matrix:

Even if the likelihood of increasing Coca Cola sales is significantly higher with Mormon Soda Consultants based on the likelihood matrix, the outcome matrix dictates that she will always hire McKinsey if Coca Cola has the funds to do so. The Trumpian “You’re Fired” scenario looms too large to ignore.

McKinsey has built such a strong reputation in the industry that they are considered the gold standard. According to corporate America, any problem they can’t solve might be unsolvable.

Hence, the saying was born that continues to permeate: “No one was ever fired for hiring McKinsey”

Politics make it hard for specialized services to crack into legacy business revenues, as they have logos and a reputation to stand on. So, with that as the backdrop, where does the crypto services business stand today?

Where crypto-services fall short

As someone running an agency that specializes in bringing legacy IP to the blockchain, I can tell you, winning deals isn’t easy, even when you are person B and you’re competing against person A.

Everyone is claiming to do everything, and generalist solutions are attracting legacy IP:

NFT Marketplaces claim to help clients strategize on the best possible NFT strategy for their business

Traditional talent agencies (e.g., CAA, UTA) are scrambling to understand the crypto landscape to help usher their clients on-chain

Here’s where these solutions fall short:

NFT marketplaces: The reality is that NFT marketplaces are a great place to sell your NFTs, but won’t help build them with the “so what?” in mind. If someone comes to us and their first sentence is “we want to sell 500 NFTs at $1k a pop and sell-out, can you help us?” I know we won’t be helpful.

NFT marketplaces can handle that type of job, as the incentives are already perfectly aligned: sell-out and throw a big party. To us, this is only a small part of what NFTs are about, raising new capital.

But what to do with that capital? How do you continue to keep people engaged? What’s the purpose of the project within the larger organization? How can we reach the highest value customers that will continue to engage with the NFTs, rather than random people on the internet? We started En Passant Digital to help clients answer these questions.

These are the hard questions that have to be answered to get beyond the “scribbles” stage of NFTs. NFT marketplaces aren’t built to thoughtfully examine businesses, their goals, and the role that NFTs can play in a new business line. The goal of NFT marketplaces is to acquire more users and sell out every NFT drop.

Talent agencies: Traditional talent agencies have access to an incredible bank of intellectual property. The opportunity to connect pieces of this IP together, on-chain, to create a sum that’s greater than its parts, is sitting right there in front of them. Allow smart creators to help evangelize great IP and delicately weave it through our culture.

However, the temptation of clients to sell scribbles for cash pervades the space. The paintbrush is sitting there, and talent agencies can help dip the paintbrush in water, but if the celebrity clientele dictates the NFT conversation, they will likely miss the mark. The incentives are difficult to align in this equation.

To quickly build an arsenal of talent that is crypto-focused, CAA and UTA have started to sign some of the major creators / influencers in the space. It is yet to be seen whether the knowledge of Larva Lab’s and the likes will rub off on their traditional clientele.

In the meantime, we’ll be here waiting for those that want to use NFTs to change the fabric of their brand / company. En Passant Digital is a place for those that want to wield NFT technology but where the fact that they are NFTs is hardly a selling point.

Sure, we agree that blockchain is the future, but that’s not good enough for us.

Talk to us!

If you are looking for an expert* opinion on your NFT project, or want to talk generally about the market, please reach out for a no-obligations 20 minute phone call. We have a number of technology partners at En Passant Digital that help us bring your legacy IP to the blockchain.

Email: bryce@enpassantdigital.com

*Anyone who claims to be an expert is a charlatan. They are generally snake-oil salesmen who probably also told you to buy OneCoin. From the last 4 years of our experience, we’ve realized that there are no experts in the space, as it changes by the second.

About the author: Bryce Baker is the co-founder of En Passant Digital, an NFT-focused agency bringing innovative market guidance and strategy to top-tier brands & celebrities.

Our other co-founder, John Tabatabai, has led investments for Crypto VCs and consulted for projects across the NFT space. He recently had an active role in advising, designing and creating the mechanics and infrastructure for the famous B20s, aiding in creating more than $250,000,000 of value in less than 45 days.